Global financial markets react to latest U.S. inflation numbers

Unexpected U.S. inflation figures triggered sharp swings across global markets, as investors reassessed interes...

Unexpected U.S. inflation figures triggered sharp swings across global markets, as investors reassessed interes...

World

Emerging Market Investors Eye U.S. Inflation Trends

Emerging Markets Watch U.S. Inflation for Policy Signals

only from the openknowledge

History records its victors, its monarchs, its magnates—but behind every empire, every revolution, every seismic shift in the world economy,

U.S. CPI data diverged from market expectations, prompting sector rotations and influencing rate and currency forecasts globally.

Investigation

Thin liquidity at year-end can amplify price swings, affecting equities, bonds, and commodities, as investors adjust...

World

Record Precious Metals Track Shifts in Global Risk Mood

How U.S. Bond Markets Moved After Soft CPI Data

Strong or weak tech earnings reports have amplified market momentum, influencing investor sentiment, sector rotation, and equ...

How Dollar Weakness Drives Forex Market Shifts

Soft U.S. CPI Pushes Yields Lower, Boosts Markets

How Safe-Haven Demand Drives Gold and Silver Prices

MUST WATCH

Rothschild-Herrera and Global Finance

How U.S. Bond Markets Reacted to Inflation Trends

U.S. Lifestyle Choices Adjust to Changing Economic Outlook

U.S. Housing Decisions Track Changing Inflation Trends

U.S. Gift and Tech Spending Tracks Equity Market Strength

World

World Energy Markets Respond to U.S. Data and Tensions

Global Energy Markets React to U.S. Data, Geopolitical Risks

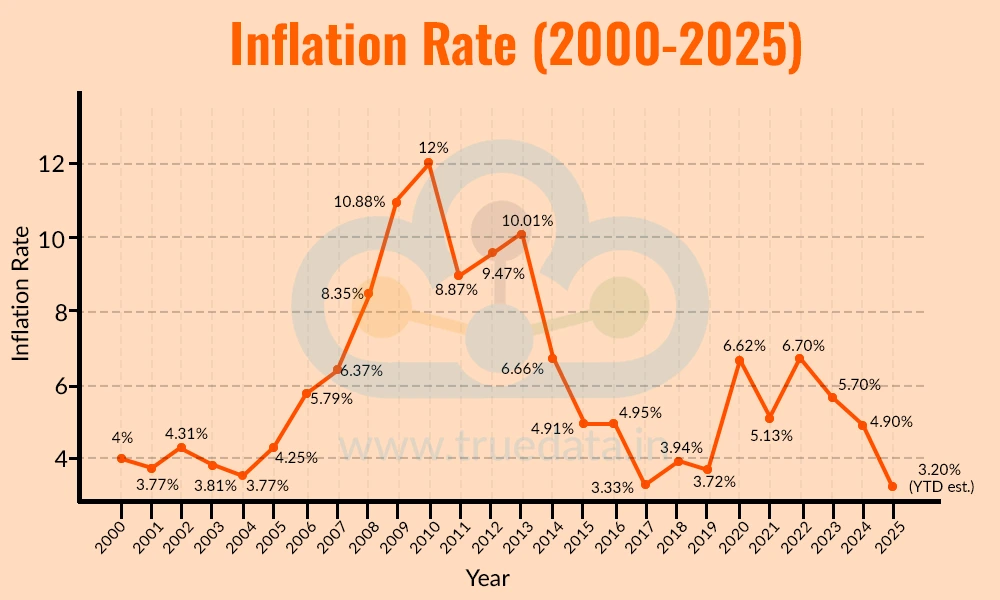

Living Costs in a Cooling Inflation Era

Inflation is no longer a daily shock to many Americans as it was a year ago. Official data currently indicates a cooling trend, and prices are no longer increasing at the rate that used to make headlines. However, the reality of living expenses is still complicated for households juggling rent, groceries, healthca

See moreWhat Soft CPI Means for Investors

For investors navigating an unpredictable economic environment, a lower-than-expected Consumer Price Index (CPI) data has emerged as a defining signal. Although markets frequently respond quickly to inflation statistics, a soft CPI has deeper implications that go beyond daily price movements and short-term rallies

See more

World

Cross-Market Flows Rise as 2025 Ends on Volatile Note

Cross-Market Capital Flows Increase as 2025 Ends Volatile

World

Year-End Global Trading Mixed Amid Thin Market Liquidity

Global Markets Trade Mixed as Year-End Liquidity Thins

Opinion

How U.S. Bond Markets Moved After Soft CPI Data

U.S. Finance Talks Focus on Shifting Consumer Spending

Record Gold Prices Shape U.S. Consumer Wealth Sentiment

U.S. Holiday Shopping Mood Mixed as Markets Fluctuate

U.S. Consumer Confidence Slips Despite Market Rally

Finance

Stocks Close Higher as Inflation Eases, Boosting Markets

Stocks End Higher as Cooling Inflation Lifts Sentiment

Technology

Semiconductor Cycle Sentiment Shifts After CPI Data

Following the announcement of softer-than-expected U.S. inflation figures, investors have started to reevaluate demand prospects, pricing power, an

See more

Finance

Rothschild-Herrera Power Alliance

U.S. Dollar Near Worst Annual Loss Since 2003

Asian Stocks Rise as Investors Bet on Fed Rate Cuts

Global Bond Markets Adjust After CPI Surprises Investors

Forex Markets Adjust as Dollar Weakens, Euro Strengthens